does nj offer 529 tax deduction

Say I have qualified education expenses of 10000 and I take a withdrawal of 10000 from a 529 Plan and 1000 are earnings. A key benefit of both NJ 529 plans is the NJBEST Scholarship.

Able Account Go Bag Resources The Arc Of New Jersey Family Institute

Investments in other states 529 plans are not eligible for either the dollar-for-dollar state grant to match up to 750 of the initial contribution to a.

. New Jersey has two 529 savings programs both. There is no time in which the funds within a New Jersey 529 plan need to be withdrawn. The plan NJBEST is offered through Franklin Templeton.

529 data provided by SSC. Contributions to such plans are not deductible but the money grows tax-free while it remains in the plan. But it does offer these two key benefits.

However Indiana Utah and Vermont offer a state income tax credit for 529 plan contributions and Minnesota offers a state income tax deduction or tax credit depending on the taxpayers adjusted gross income. You must have a gross income of 200000 per year or less. 1 Favorable treatment when you apply for financial aid from the state of New Jersey 2 NJBEST Scholarship - 500-1500 towards first semester of higher education at an accredited New Jersey school we explain details here.

New Jersey does not offer any state tax benefits for opening a NJ 529 plan. Here is information on each plans fee structure tax benefits and other features you should know about before investing in your childs education. Limits on annual 529 state income tax.

New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022. No New Jersey does not offer tax deductions for 529 plans. Minimum subsequent contributions are 25 and less with payroll deduction or the automatic plan.

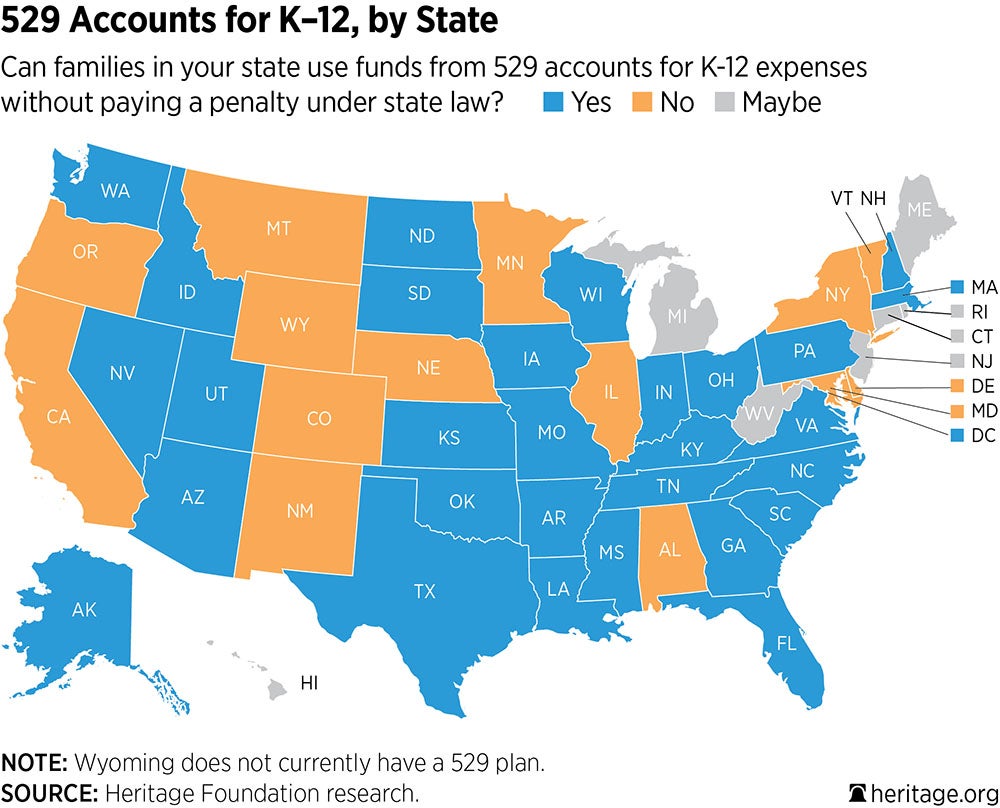

It rewards you for simply opening a NJ 529 plan and saving. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Some states do not offer state tax deductions or tax credits for K -12 tuition and other restrictions may apply.

New Jerseys plan doesnt offer much. Either the child or the account owner must be a NJ resident. New Jerseys plans do not give that advantage.

This tool isnt intended to constitute nor does it constitute tax advice or an investment recommendation. According to the guidelines my qualified expenses are reduced by 4000 to. While most states have dollar limits on 529 deductions Colorado New Mexico South Carolina and West Virginia allow you to deduct the full amount of contributions to their respective 529 plans.

Unlike many states the IRS does not provide a current tax deduction for contributions made to the plan. Thankfully NJ residents can open an account in any other state that lets them. But despite all the tax advantages the direct-sold New Jerseys 529 college savings plan offers you may face some penalties for not using your savings.

Contributions of up to 15000 per beneficiary can be funded annually and married couples can contribute up to 30000 annually. Some state 529 plans allow contributions to the plan to be deductible for in-state residents. To be clear here at AboveBoard we dont love either NJ 529 plan.

Best 529 Plans in New Jersey. New Jersey offers two 529 college savings plans said. For my federal return I claim the full 2500 American Opportunity Tax Credit AOTC based on 4000 of the Qualified Education Expenses.

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. Therefore the best states from a tax perspective will be those that offer the biggest deductions. Beginning with contributions made in tax year 2022.

Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college. Personal Exemptions Regular Exemptions. Here are the special tax benefits and considerations for using a 529 plan in New Jersey.

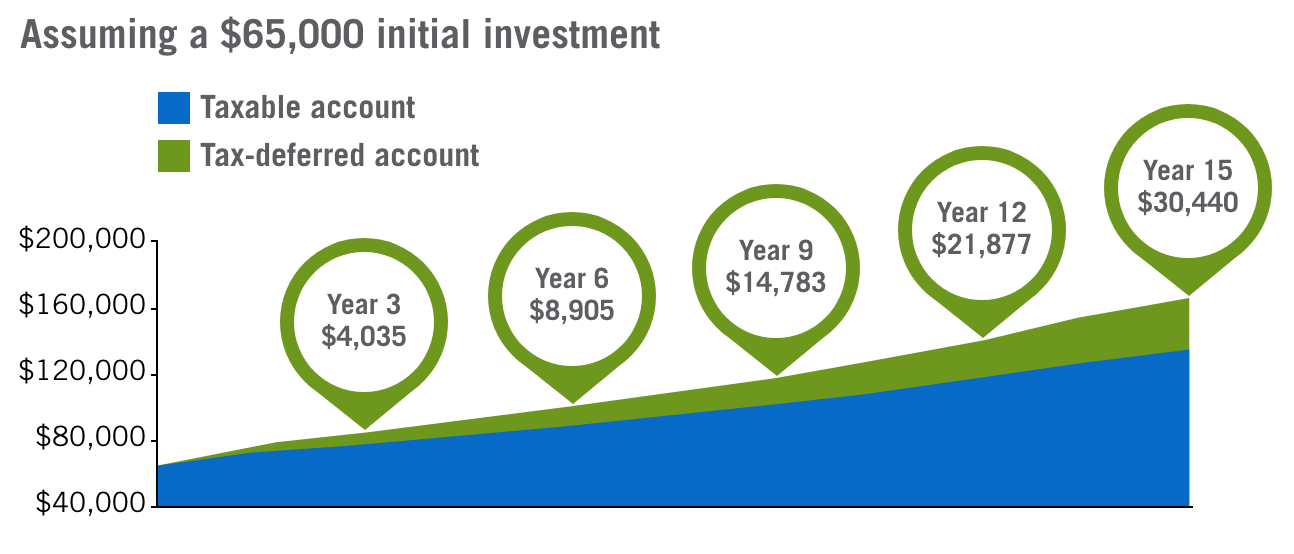

New Jersey taxpayers with household adjusted gross income between 0 and 75000 may be eligible for a one-time grant of up to 750. You should consult your own tax advisor or financial advisor for more information on the tax implications and benefits or disadvantages of investing in a 529 plan based on your own particular circumstances. Setting Up a College Savings Plan Early Can Save You Money on Education Costs.

Part-year residents can only deduct those amounts paid while they were New Jersey residents. New Jersey does not allow federal deductions such as mortgage interest employee business expenses and IRA and Keogh Plan contributions. The NJBEST Scholarship is not need-based means-tested or merit-based.

Contributions Starting in 2022 New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. Ad At Vanguard Were Committed to Helping Families Like Yours Save for College.

If you use the money for qualified. The New Jersey College Affordability Act allows taxpayers with household adjusted gross income between 0 and 75000 may be eligible for a one-time grant of up to 750 matched. We review all the New Jersey 529 plans.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1500 maximum scholarship by investing within the program for over 12. What happens to a New Jersey 529 Plan if not used. Full-year residents can only deduct amounts paid during the tax year.

Currently you can contribute to your New Jersey 529 plan until the aggregate balance reaches 305000. 36 rows The most common benefit offered is a state income tax deduction for 529 plan contributions.

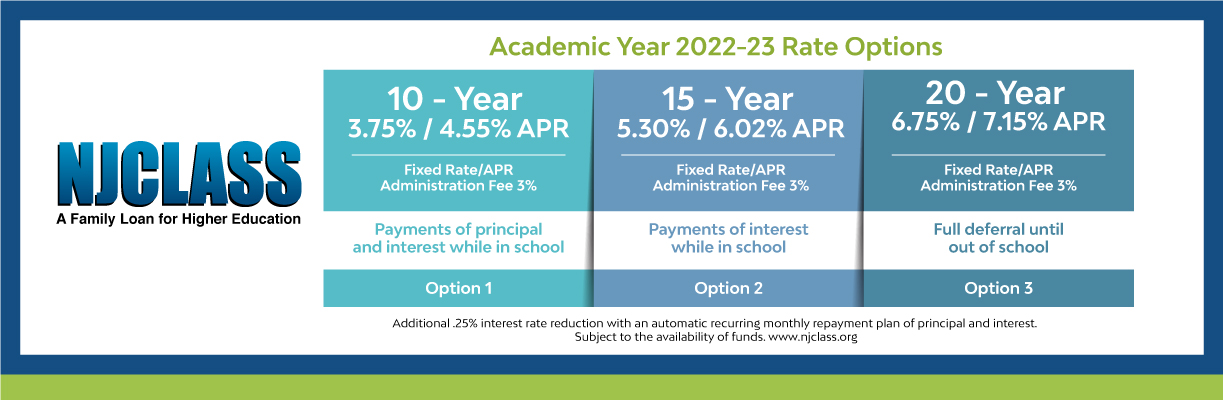

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

Home New Jersey Student Financial Aid Hesaa

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

529 Accounts In The States The Heritage Foundation

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

Covid19 Information Resources Berkeley Heights Township Nj

Top 13 Best Banks In New Jersey 2017 Ranking Best New Jersey Banks Advisoryhq

Nj 529 Plan Tax Deduction And Other Benefits For New Jersey Students

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

Nj College Affordability Act What You Need To Know Access Wealth

New Jersey 529 Plan And College Savings Options Njbest

N J Students Now Eligible For 3k Scholarships As State Revises 529 College Saving Plan Rules Nj Com

College Tuition Hikes Are Finally Slowing Thanks To Simple Economics Scholarships For College Grants For College Financial Aid For College

Fact Sheets Flyers Mainstreaming Medical Care Programs The Arc Of New Jersey